Timing your last mortgage payment before closing

When should you make your last mortgage payment? When you're selling your home, it's a detail you might overlook or even overthink. So read on for helpful information about the payoff process and the timing of your last payment before you close your sale.

TL/DR; The timing of the last payment depends on the date of the closing and the seller's mortgage terms. In general, we recommend sellers make the final payment 7 days before closing. But don't sweat it, if you overpay, lenders are required to pay any overages back within 30 days.

Keep reading to see how our firm helps sellers manage this important detail for clients.

Here's how it works:

If a seller has a mortgage, it must be paid off and the lender's lien must be released as part of the closing process.

If the seller is our client, we request a payoff demand letter so that we know how much the seller will pay from the proceeds of the sale. The lender will then issue a payoff statement that includes the balance due, mortgage interest (calculated to the day the loan will be paid off), and any additional fees.

The lender's payoff statement typically includes:

- The balance of the principal loan

- All accrued mortgage interest through the date they will receive the funds

- Reimbursement for any costs advanced (legal fees for a foreclosure, etc.)

- Any deficits in the escrow account (tax and insurance payments they made even though you did not have enough money in escrow to cover the bills)

- Late payment fees

- Other administrative charges such as the cost of recording a "Release of Mortgage" or for fax delivery of the demand statement (Yes, lenders still send faxes and charge fees to do so.)

So, when should you pay your last mortgage payment?

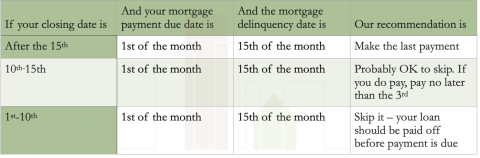

It depends on your closing date and the terms of your mortgage, which should be on your mortgage statement.

Most mortgage payments are due on the first day of the month but allow a 15-day grace period. In other words, lenders only charge late fees if the payment is received after the 15th.

If you have additional loans, check them too. Some loans, like second mortgages and equity lines of credit, may have different due dates and grace periods.

A few more notes:

Remember to cancel autopay

If you have autopay on your loan, cancel it early enough so that the lender does not take funds erroneously.

Give yourself some time

If you are going to make a last payment, make sure you pay it early enough for funds to clear at the lender's end and are credited against the balance due. If you are closing on the 5th, do not leave it until the 3rd to send it in. We recommend making payment no later than 7 days before closing.

What happens if you overpay?

Don't sweat it. Your lender is obligated to promptly return all overpayments. We share this guidance in hopes that you avoid any. But, if that happens, the lender will return all excess funds within 30 days of the loan repayment. You are covered even if they collect one last payment.

Schedule a call with John, our lead attorney, or me (Mike) to learn more about closing your real estate transaction with confidence.

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.